How Financially Literate Are You?

Test your fin-lit smarts and see how you compare with the general U.S. population!

Quiz Transcript

How Financially Literate Are You?

Test your fin-lit smarts and see how you compare with the general U.S. population!

Suppose you have $1000 you want to invest. Which would be the safer way to invest it?

Put your money in one investment.

Put your money in more than one investment.

Don't know.

1 / 9

Suppose you deposit $100 in a savings account paying 10% interest, compounded annually, and you do not remove any money. How much money will you have in the account after five years if you do not remove any?

More than $150.

Exactly $150.

Less than $150.

Don't know.

2 / 9

Imagine your savings account is earning 1% per year and inflation is 2% a year, both compounded annually. After one year, how much would you be able to buy with the money in this account?

More than today.

Exactly the same.

Less than today.

Don't know.

3 / 9

True or false: A 15-year fixed-rate mortgage typically requires higher monthly payments than a 30-year fixed-rate mortgage, but the total interest over the life of a 15-year will be less than the 30-year.

True

False

Don't know.

4 / 9

True or false: Buying a single company's stock generally provides a lower risk return than an equity exchange-traded fund.

True

False

Don't know.

5 / 9

If you were applying for a loan, would you prefer a lower or higher interest rate?

Lower interest rate

Higher interest rate

Don't know.

6 / 9

If you were signing up for a savings account, would you prefer a lower or higher interest rate?

Lower interest rate.

Higher interest rate.

Don't know.

7 / 9

Which portfolio has the most aggressive risk level?

80% stocks, 20% bonds

10% stocks, 90% bonds

50% stocks, 50% bonds

8 / 9

If you had $1,000 to invest in a moderate risk fund, what would you expect the average rate of return to be after 1 year? (based on historical performance)

0-15%

16-30%

31% or more.

9 / 9

Fin-Lit Fail

Don't despair! Now you just know how much you don't know, and you're ready to start learning.

Financial Literacy Newbie

Your financial literacy could use some work. The good news! Stash is investing, simplified.

Fin-Lit Freshman

Not bad! Not bad at all! You scored as well, or better, than the general U.S. population! But there's still some room for improvement.

You're Fin-Lit!

Your financial literacy is seriously on point! You scored as well as users of Stash and better than the general population of the United States! Great job!

Get started today

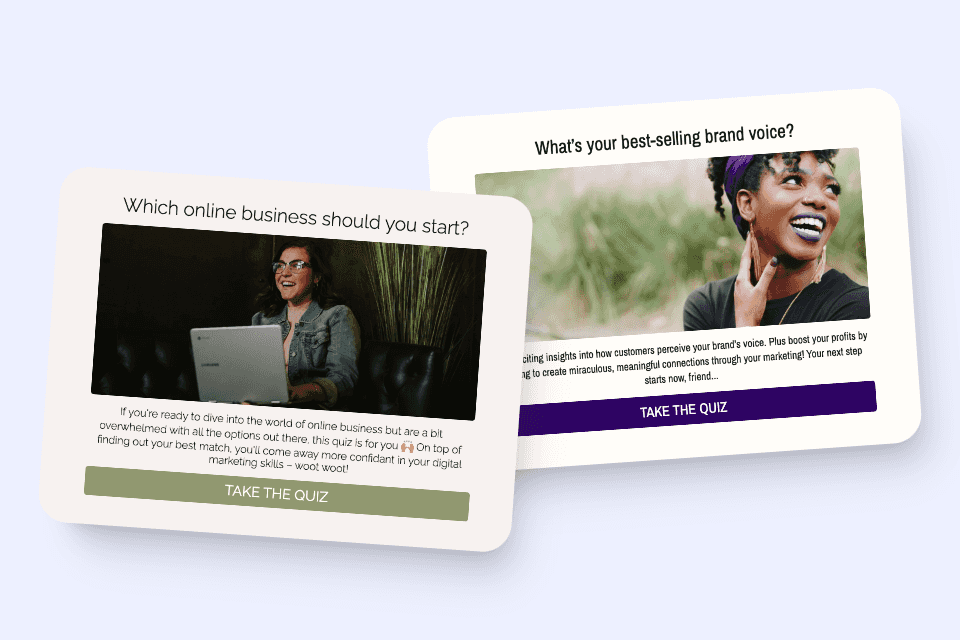

Use our AI quiz maker to create a beautiful quiz for your brand in a minute.

Make a quiz - for free