The 15 Minutes Money Audit

Rewrite Your Money Story in 15 Minutes

Quiz Transcript

The 15 Minutes Money Audit

Rewrite Your Money Story in 15 Minutes

When you think about your money, what feeling comes over you?

I feel great... I have more than enough to live and I don't worry about money in the future

I feel a little uneasy... even though my day to day expenses are taken care of I worry about the future

I am anxious... Every month I feel a little further behind or like I am not saving enough for the future

Blind terror... there is never enough money to live and I have no savings or plan for the future

1 / 10

When you think back to your childhood, the attitude about money was...

We choose where we spend our money and we have more than enough

We live well day to day and there isn't a lot extra for luxuries

We're getting by and as long as we won't have an emergency we're fine

We don't have enough to live and we will always struggle

2 / 10

As a kid, your friends got a new toy that you want too, you ask your parents for money to buy one...

They agree to purchase the item

They work out a deal to pay for a portion of the item and help you earn the money for your share

They tell you to add it to your Christmas or Birthday list

You don't ask, the answer is always no anyway, and you don't want to get yelled at

3 / 10

How would you describe your daily spending habits?

I plan my spending in advance and rarely dip into my savings for needs and wants

I spend as I need to and use credit or savings to cover my needs and wants when necessary

I spend what I need to and will deal with the bills when they come in, that's what credit is for?

I never know what I am spending and am always surprised by the bills but there is never enough money to go around anyway

4 / 10

You open your mailbox to a pile of bills. You look at the bills and think...

That bills are a part of life, it's just another day, no biggie

Are grateful that you have the money to pay all of the bills in your mailbox

Sigh and wonder if you will have enough money to pay all of the bills

Know that you don't have enough money to pay all of the bills in the pile and wonder what you can live without this month

5 / 10

Congratulations-- you got a bonus at work! What do you do with the money?

Spend some on a vacation, save some for retirement and pay off some debt... life is about balance

Straight to the retirement account, I'll feel safer knowing I'll have more money when I retire

Splurge on a night out or sensible new outfit to celebrate, and put the rest in savings or toward debt repayment

Pay off some bills... whew, I can get caught up!

6 / 10

You and your spouse are looking at the budget tonight, you know that...

You know that you will have an open and frank conversation and come out with a plan that you will both be happy with

You know that you will have a tense conversation and you'll both compromise to get to a good plan

It's going to be a fight and one of you might end up sleeping on the couch tonight

What conversation? All we do is fight about money, there's no point, we'll keep getting by as we have been

I don't have a spouse

7 / 10

At the start of the month, you feel like...

You don't worry about paying the bills or saving for the future, you've got everything under control!

It's going to be tight, but you know you can squeak by for another month

As long as nothing unexpected pops up you should be OK... fingers crossed.

You are in the hole before the month starts, just like last month

8 / 10

At the end of the month, you find that...

All the bills are paid and there is a lot left over to pay off debt, put into savings, retirement or extras

All the bills are paid and there is a little left over to help pay off debt or add to your savings

There was enough money to just pay the bills, nothing extra

There is nothing left over and some of the bills didn't get paid this month

9 / 10

If you honestly compare the start and the end of the month you realize that...

You are reasonable about your money reality, you don't worry needlessly and are feeling pretty good about your money situation

You worry a little more than you should about not having enough money and everything always works out fine at the end of the month

You realize you should have been more thoughtful at the start of the month and now you're feeling a lot worried and today and the future

You know exactly where you start and end the month, in the hole, and it is wearing you out mentally and emotionally

10 / 10

Master of Your Money

You are one with your money!

You have a great relationship with your money and are neither worrying or hording money waiting for the big problem to emerge.

The action that will have the biggest impact on your short and long term success is discovering ways to leverage your money relationship to achieve your goals faster. Yay You!!

The Waiting Worrier

Money worries crosses your mind frequently, and while it's not crippling you you'd be better off without them.

The worry is trying to keep you safe, but in reality it's not serving you anymore.

The action that will have the biggest impact on your short and long term success is identifying the belief and purpose of the worry so you can build a healthier relationship with your money.

The Silent Stresser

You are living in a constant state of stress verging on panic because you are always waiting for the next problem to show up.

And your waiting is always rewarded, the next problem always emerges. The stress is your bodies reaction to fear and was designed to keep you safe, but it's time to get out of the super stress cycle.

The action that will have the biggest impact on your short and long term success is identifying the belief and purpose of the stress so you can move onto building a healthy relationship with your money.

The What Now?

You are struggling to survive, and it's exhausting! No matter how hard you work or how much money you make you never feel like you are getting ahead.

What we think about we bring about, and you are living in a constant state of "not enough-ness". This seed was planted long ago in your subconscious and is in charge every day.

The action that will have the biggest impact on your short and long term success is getting to the root cause of your belief system so you can stop the cycle and begin to build a loving relationship with your money.

Get started today

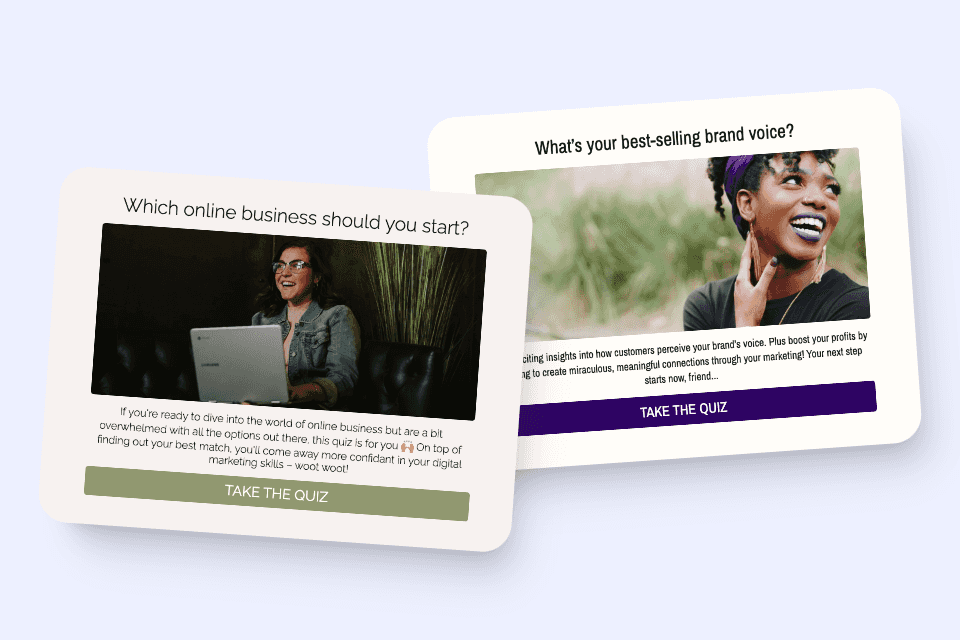

Use our AI quiz maker to create a beautiful quiz for your brand in a minute.

Make a quiz - for free